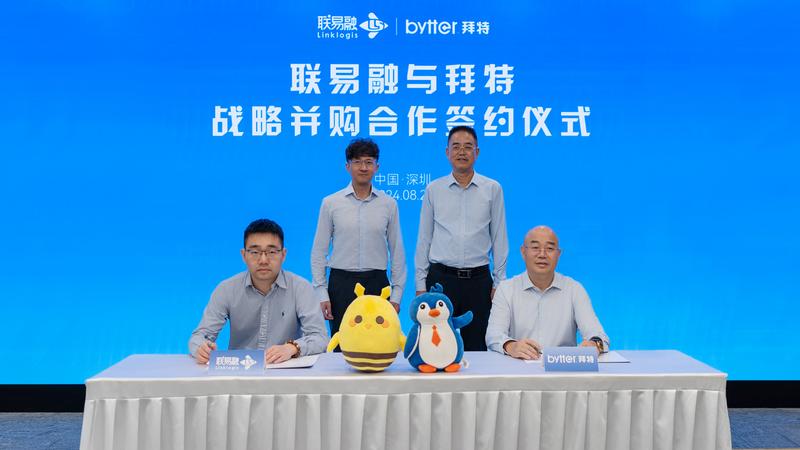

On the afternoon of August 29, Linklogis Inc. (“Linklogis”) and Shenzhen Bytter Technology Co., Ltd. (“Bytter”)’s shareholder held a signing ceremony for strategic acquisition. Both parties signed the Letter of Intent for Acquisition, wherein Linklogis intends to acquire the shares held by Bytter’s current controlling shareholder. Upon completion of this transaction, Linklogis will become the controlling shareholder of Bytter. This strategic acquisition aims to integrate the core strengths of both companies in treasury management and supply chain finance technology, jointly assisting customers in building world-class financial management platforms and advancing intelligent treasury management systems for state-owned enterprises and large-and-middle-sized private enterprises.

Ji Kun, Co-founder and President of Linklogis, Zhao Yu, Chief Financial Officer of Linklogis, Hu Defang, Founder and Chairman of Bytter, and Hu Dexiang, General Manager of Bytter attended the signing ceremony.

Since its establishment in 2000, Bytter has specialized in providing treasury management solutions for enterprises. Bytter was listed on the over-the-counter trading platform operated by the National Equities Exchange and Quotations Co., Ltd. (stock code: 834596.NEEQ) in 2015, and has become a leading company in the treasury management sector. As a national high-tech enterprise, Bytter offers a comprehensive range of solutions, including group treasury management systems and core business systems for finance companies. Bytter possesses the technical implementation capabilities for all 11 treasury function modules required by the State-owned Assets Supervision and Administration Commission of the State Council (SASAC) and has assisted over 1,500 enterprises in achieving digital transformation in treasury management.

As a leading supply chain finance technology solution provider in China, Linklogis is dedicated to facilitating the ecological interconnection of “industry chain – transaction flow – finance.” In recent years, Linklogis has successfully won the bidding for comprehensive supply chain platforms of state-owned enterprises and leading private enterprises. These achievements have allowed Linklogis to further expand its technological applications in treasury management, showcasing its expertise and leadership in financial technology.

Mr. Hu Defang, the founder and chairman of Bytter, said, “With the rapid evolution of digital information technology, treasury management is shifting from traditional cash management to advanced treasury systems focused on value creation and strategic guidance. For over twenty years, Bytter has been committed to offering comprehensive solutions, including treasury management consulting, software development and implementation, and system integration for corporates, finance companies, and banks. Through this acquisition transaction, we will partner with Linklogis to enhance our expertise in treasury management and drive the digital transformation and reform of enterprises, aiming to provide efficient, secure, and intelligent treasury management solutions to our customers.”

This acquisition capitalizes on Bytter’s extensive technical expertise and service experience in treasury management to bolster Linklogis’ comprehensive financial management digital transformation services for enterprises. By collaborating closely with Bytter, Linklogis will expand its product and service offerings, strengthen its technological and market leading position in treasury management, and support customers in achieving high-quality development.

Mr. Ji Kun, the co-founder and president of Linklogis, highlighted, “This acquisition is a strategic move to broaden our business scope and a key step in responding to evolving market demands. Intelligent treasury management is crucial for the development of enterprises. By integrating Bytter’s technological strengths and customer resources, Linklogis will enhance its industry-finance treasury solutions and solidify its leading position in financial technology. This transaction will significantly elevate Linklogis’ product capabilities and core competitiveness, maximizing company value and returns for shareholders.”