Puffer Finance, a leader in decentralized infrastructure solutions, has announced key updates to its roadmap that underline its commitment to refining Ethereum’s ecosystem. Initially launched as a Liquid Restaking Protocol (LRT), Puffer Finance has expanded its offerings into a comprehensive suite of synergistic products designed to enhance Ethereum. The latest roadmap details include advancements in AVS (Actively Validated Services), based rollup solutions, a forthcoming upgrade to the Puffer Restaking Protocol, and plans for a Token Generation Event (TGE) and withdrawal.

Puffer’s Key Milestones and Upcoming Innovations

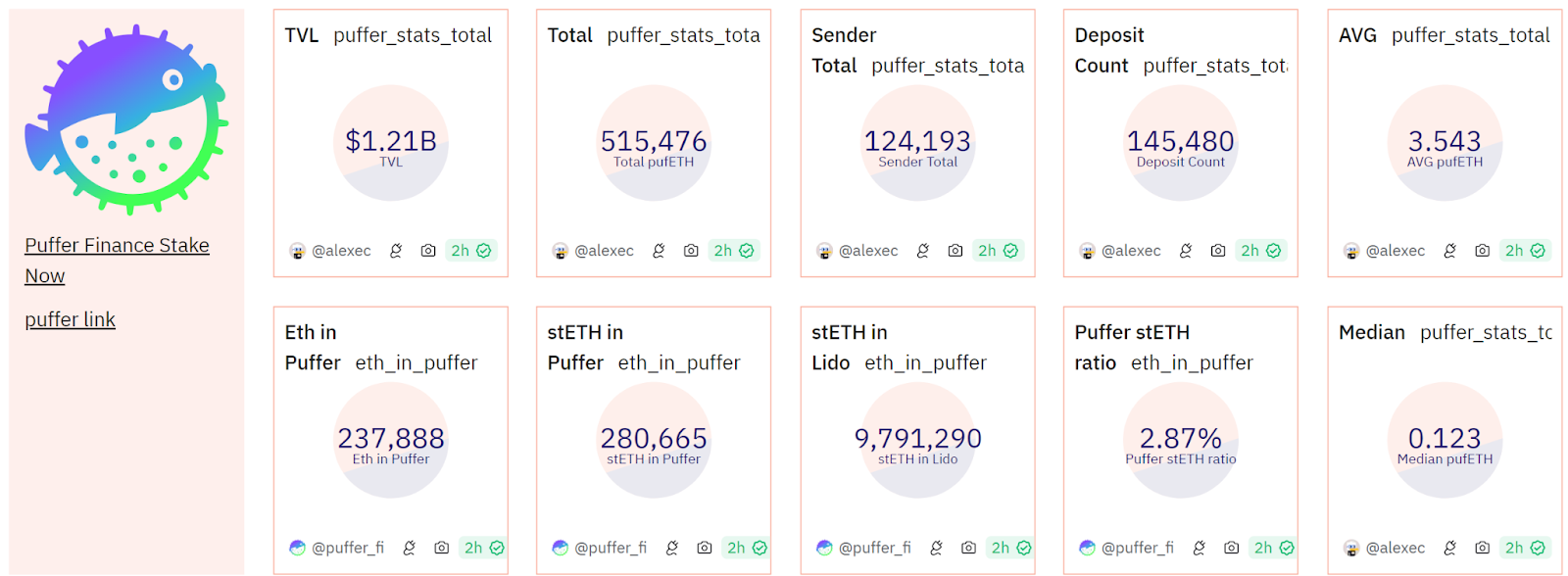

Puffer Finance has made significant strides in the restaking space, with over 500,000 ETH in Total Value Locked (TVL) and integration across numerous DeFi platforms. This growth reflects the network’s strength, with over 5,000 node operators contributing to its decentralized infrastructure. The upcoming innovations are set to further this momentum.

Source: Puffer’s Dune Dashboard

Launch of UniFi AVS: Set to launch at the end of August, UniFi AVS introduces a pioneer approach to transaction processing with pre-confirmations for Layer 2 transactions, achieving speeds of up to 100 milliseconds. This advancement significantly enhances liquidity and capital efficiency, addressing current DeFi challenges and paving the way for a more unified and competitive Ethereum ecosystem.

Puffer UniFi Rollup Testnet: Scheduled for a September release, the Puffer UniFi Rollup testnet represents a significant evolution in based rollup technology. As the first atomically composable rollup, UniFi is crafted to unify Ethereum by addressing liquidity fragmentation and centralization. Unlike traditional rollups that rely on centralized sequencers, UniFi leverages Ethereum validators for sequencing, enhancing neutrality, capturing value back to Layer 1 (L1), and promoting home staking. These features are essential to Puffer’s mission of preserving Ethereum’s decentralized nature and improving user experience through seamless interactions across different app chains.

Jason, Core-Contributor at Puffer, explains: “Our goal is seamless user experience—making UniFi feel effortless. With technologies like chain and account abstraction evolving, users can manage assets smoothly across different app chains. For more risk-averse users, they can maintain assets on Layer 1, deposit into a based-app chain, execute actions, and withdraw—all within the same block.”

Puffer Restaking V2: Expected in early Q4 2024, Puffer Restaking V2 will introduce major enhancements for validators and node operators, such as Fast Path Rewards, Globally Enforced Anti-Slashers, and a reduced bond requirement by 50%. These updates aim to make decentralized validation more accessible and cost-effective, promoting broader participation in Ethereum validation.

Token Generation Event (TGE) and Withdrawal: Also planned for early Q4 2024, Puffer Finance will launch its TGE for the $PUFI governance token, a critical element designed to drive participation and governance across the ecosystem’s products, including UniFi AVS, UniFi Rollup, and Puffer LRT. Alongside the TGE, the withdrawal function for ETH stakers will be rolled out, designed to offer a secure and user-friendly experience.

Puffer’s Strategic Vision for Ethereum’s Future

Puffer Finance is committed to building a decentralized, secure, and efficient Ethereum ecosystem. The strategic roadmap outlined by Puffer highlights a future-focused approach to overcoming the challenges of liquidity fragmentation and centralized control, reinforcing Ethereum’s leadership position in the blockchain space.

“Puffer is redefining the scalability and efficiency of Ethereum by innovating beyond traditional rollups,” added Amir, Core-Contributor at Puffer. “Our innovations are crafted to drive the mass adoption of Ethereum, supporting its long-term growth and resilience. “

Explore the Future with Puffer Finance

Puffer invites developers, Ethereum enthusiasts, and the wider blockchain community to engage in the transformative journey of revolutionizing Ethereum. Dive into the UniFi litepaper for a comprehensive overview of the latest technologies, or participate in the upcoming TGE event to get involved in the Puffer ecosystem.

For media inquiries, interviews, or further information, please contact Puffer Finance through their official channels:

Twitter: @puffer_finance & @puffer_unifi

Discord: Puffer

Telegram: Puffer Community

About Puffer Finance

Puffer Finance is pioneering permissionless infrastructure on Ethereum through innovative decentralized solutions. Puffer offers a suite of synergistic products, including liquid restaking (LRT), Based Rollups, and a preconfirmation AVS. Powered by natively restaked validators and the AVS, the UniFi based rollup stack addresses liquidity fragmentation across Ethereum while providing instant settlement (1 block vs 7 day withdrawals) and 100ms transactions.

Puffer Finance has raised $5.5 million in a seed round co-led by Lemniscap and Lightspeed Faction, followed by an $18 million Series A funding round led by Brevan Howard Digital and Electric Capital, and a strategic investment from Binance Labs, Binance’s venture capital arm. As of August 2024, Puffer ranks second among Liquid Restaking Protocols according to DefiLlama, with over 500,000 ETH in Total Value Locked (TVL), valued at $1.4 billion. The platform is integrated with numerous DeFi platforms, broadening its reach and impact within the Ethereum ecosystem.

Disclaimer: The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. Cryptocurrency mining can be risky. There is potential for loss of funds. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities.