April 23, 2020 – DigitalBits (“XDB” or “the Company”) is a protocol layer blockchain for branded currencies. DigitalBits originated from a fork with Stellar in 2017 and shares many of the same features but differ in aspects that allow it to create branded currencies.

OVERVIEW

DigitalBits is a blockchain built for brands. Large brands continue to face competition from direct-to-consumer competitors, and branded currencies provide a new way to connect with consumers while increasing loyalty and engagement. KPMG released a survey report in 2019 discussing how blockchain-enabled digital tokenization is poised to transform commerce. The survey highlights how more and more people are opening up to the idea of how blockchain technology can transform loyalty programs with 55% of respondents saying that tokens will enable them to make better use of loyalty reward points. Companies such as DigitalBits make it easier for consumers in the United states to utilize the $16 billion which is generated annually in loyalty rewards that are unredeemed. Starbucks demonstrates a lucrative reward programs although not blockchain, its loyalty rewards program accounts for approximately 40% of all US sales.

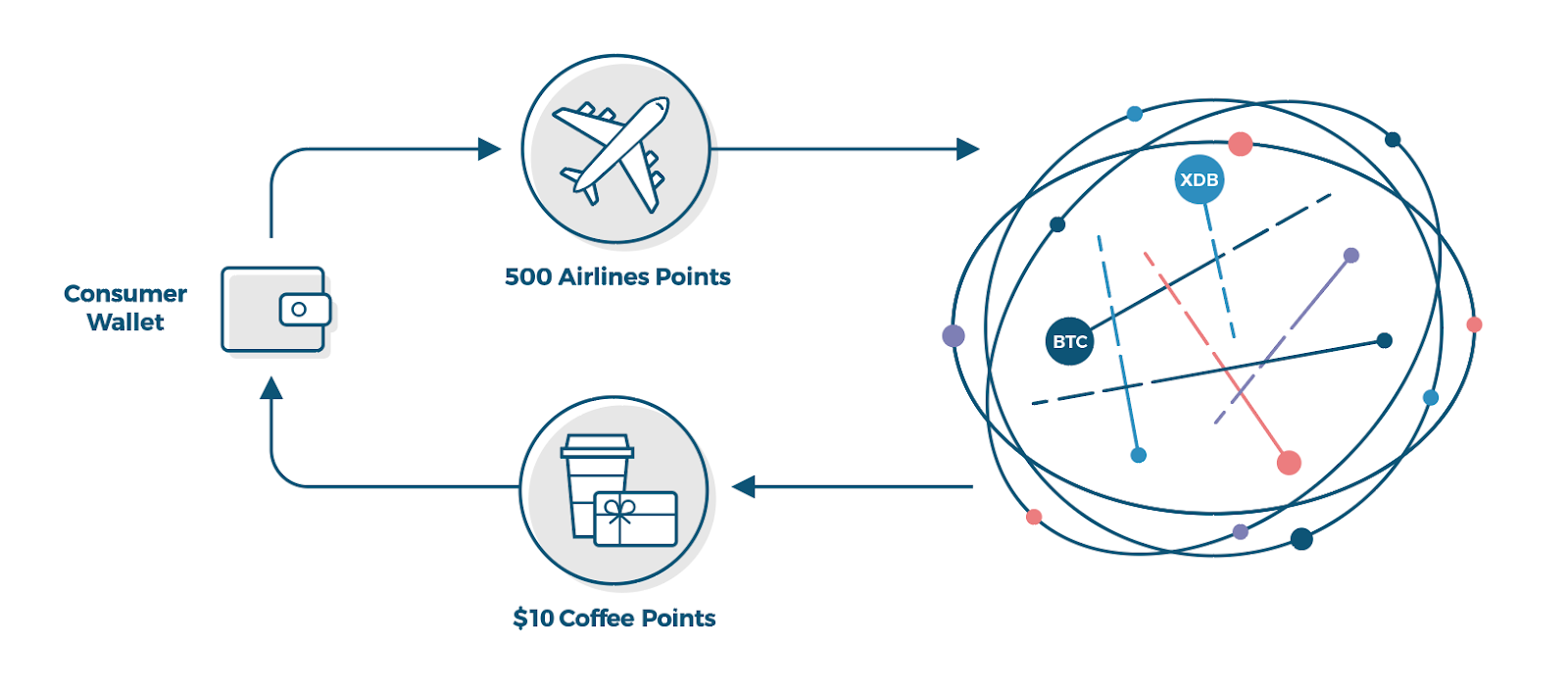

There are many features that DigitalBits offers which form a unique proposition for the client. DigitalBits offers a user-friendly solution for companies to create their own branded cryptocurrency. DigitalBits’ ability for brands to integrate directly into consumer apps will lead to wider adoption. (A KPMG survey notes that 82% of respondents said they would be willing to use tokens as a part of a loyalty program they belong to. Digitalbits also allow trading even if no direct market exists through its use of multi-hop technology. The use case for an intercoin trading market without the use of an external exchange, will be crucial in making different branded currencies tradable. DigitalBits is creating a new shift in valuation of loyalty programs and with the expansion of their branded tokens and ability to trade them should increase the value and potentially create a premium for certain loyalty tokens. The basic functionality of the Company’s on-chain multi-hop protocol is illustrated below:

COMPETITION

DigitalBits is not the only blockchain company working in the branded currency space. Others include Qiibee, Loyyal, and Tata Consultancy. Qiibee is a Swiss company which looks to unleash the untapped potential of blockchain. They are currently working with several European enterprises on their loyalty programs including Latesso, which is the second largest coffee producer in Switzerland. Loyyal is a San Francisco based company focused on its patent-pending solution which is designed for the management and delivery of traditional loyalty programs, employee incentives, and even credit card rewards. Recently, Loyyal signed a three-year agreement to provide a blockchain-enabled loyalty rewards platform for Emirate Group that is now in production at Emirates Skywards. Tata Consultancy Services (TCS) is part of the Tata Group, a large-multinational organization, which was founded in 1868. In October of 2019 TCS launched a blockchain-based multi-brand customer loyalty platform using R3’s Corda. TCS’s solution allows users to manage loyalty and rewards points from different brands, all in one place. Below is a comparison of some basic aspects of the aforementioned competitors:

TOKEN UTILITY

The XDB token has several utilities including fees, payments, as a bridge, and authentication. These utilities also help to improve the token velocity which in-turn improves overall liquidity. Liquidity will be crucial for large adoption and adoption of new brands. The authentication feature also helps to act as an anti-spam feature.

- Authentication – a minimum of 10 DigitalBits is required to authenticate accounts and activate the send function

- Bridge Token – DigitalBits can act as a bridge token to facilitate trades for asset pairings that may lack a large market

- Payments – DigitalBits can be utilized for fast, low cost payments and remittances

- Transaction Fees – each transaction on the DigitalBits network is subject to a minimal fee of 0.00001 DigitalBits

TOKEN DATA

TOKEN DISTRIBUTION

TEAM

The team behind Digitalbits is led by CEO & Founder, Al Bergio. He is an experienced entrepreneur and the company he previously founded, Console, was acquired by PCCW Global. The rest of the leadership team is composed of Michael Luckhoo (VP Operations), Thomas Madej (director of DevOps), and Rajiv Naidoo, (Head of Community & Research). One of their advisors include Julie Lyle who previously was Chief Marketing Officer at Walmart. The other team advisors have relevant experience to assist Digitalbits in executing their roadmap successfully.

RISKS

Risks to the project include a decrease in consumer spending or extended lockdown due to the coronavirus pandemic. This may negatively impact DigitalBits ability to form partnerships with large consumers brands. Another risk is that the competition will beat them to large consumer brands and take market share from DigitalBits. Increased competition could negatively impact DigitalBits overall profitability.

CONCLUSION

Overall there are many reasons that DigitalBits provides an attractive opportunity in the blockchain space:

● Ability for easy mass adoption

● Great leadership team & advisors

● Loyalty points is one area where blockchain can easily increase efficiency

● Reward programs and loyalty points help brands increase user engagement

There are risks to this company which could materially impact its ability to be successful but looking forward to the future, DigitalBits appears to be positioning itself to leverage partnerships with top-tier consumer brands. The company’s 2020 roadmap has partnership announcements later this year and it will be interesting to see how the company contends with the competition going forward.

DISCLOSURES

This research is for information use only. Other than disclosures relating to Alpha Sigma Capital Fund, LP this research is based on current public information that we consider reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates, and forecasts contained herein are as of the date hereof and are subject to change without prior notification. We seek to update our research as appropriate.