Introduction

The public markets are increasingly looking for ways to gain exposure to crypto assets, a trend that has sparked discussions about valuing stocks tied to digital currencies. Companies like MicroStrategy have become focal points of this shift, offering insights into the evolving market dynamics as traditional investors explore ways to integrate crypto exposure into their portfolios. This lack of access to crypto-related products through traditional financial institutions created a significant gap for investors eager to gain exposure to Bitcoin. With wealth advisors and many institutions unable to recommend Bitcoin ETFs or other crypto investment vehicles, investors turned to alternative assets like MicroStrategy to fill the void. As a company that transformed itself into a “Bitcoin Treasury,” MicroStrategy became a proxy for Bitcoin exposure, allowing investors to indirectly participate in Bitcoin’s price movements through its stock. This workaround became especially popular among clients of firms that restricted direct crypto investments, driving up MicroStrategy’s valuation far beyond the value of its Bitcoin holdings. Morgan Stanley only recently, in August 2024, allowed its advisors to recommend Bitcoin ETFs, highlighting how even major institutions are just now beginning to feel more comfortable with crypto product recommendations. For many, it was the only accessible option to gain exposure to Bitcoin within the constraints of traditional brokerage accounts, further illustrating the demand for regulated pathways to crypto.

The MicroStrategy Phenomenon: Trading Beyond Bitcoin’s Value

MicroStrategy’s journey from a modest software company to a crypto-market heavyweight is nothing short of extraordinary. Reaching a staggering market cap of $106 billion in the past week, the company now stands alongside household names like Boeing, Nike, and Starbucks in terms of valuation. Yet this transformation isn’t due to its software business but to its contrarian pivot to Bitcoin, which now defines its identity.

The company’s Bitcoin acquisition strategy began in 2020, with then-CEO Michael Saylor framing it as a way to enhance shareholder value through a new capital allocation strategy. Since then, MicroStrategy has amassed 306,420 bitcoins, valued at roughly $30 billion. Despite this, the company trades at more than three times the value of its Bitcoin holdings, sparking debates about the sustainability of such a premium.

MicroStrategy’s approach hinges on leveraging convertible debt to fund Bitcoin purchases. This financial instrument allows the company to raise funds at extremely low interest rates—sometimes as low as 0%—with the option for investors to convert their debt into equity if the stock price rises. This mechanism has enabled MicroStrategy to continuously accumulate Bitcoin without significant cash outflows, but it has also exposed the company to considerable risks.

Skeptics argue that MicroStrategy’s lofty valuation is built on a precarious foundation of leverage and speculative demand. While the company’s stock price has soared in tandem with Bitcoin’s price, its underlying fundamentals tell a different story. MicroStrategy’s software business, once its core revenue driver, posted an $18.5 million loss on $116 million in revenue in the most recent quarter—a performance that hardly justifies its inclusion among America’s top 100 companies by market capitalization.

A key concern is the company’s reliance on convertible debt, which totals $4.8 billion, with an additional $2.6 billion raised in late 2024 at a conversion price of $672.40 per share. If Bitcoin were to experience a prolonged downturn, MicroStrategy could face a liquidity crisis. A significant drop in its stock price below the conversion thresholds of its debt could prevent bondholders from converting to equity, forcing the company to repay in cash. With less than $50 million in cash reserves, MicroStrategy would likely have to sell some of its Bitcoin holdings to cover its obligations, creating a downward spiral as these sales further depress Bitcoin’s price.

This scenario isn’t far-fetched. During Bitcoin’s steep correction in 2021, MicroStrategy’s stock price collapsed from $81 to $16 as Bitcoin’s value plummeted from $64,000 to $16,000. With its leverage now at record levels, any future downturn could have even more severe consequences for the company.

On the other hand, MicroStrategy’s proponents highlight its unique ability to capitalize on Bitcoin’s bull markets. The company’s use of leverage allows it to magnify the effects of Bitcoin’s price appreciation. By issuing debt or equity at a premium, MicroStrategy can acquire more Bitcoin than the value of the equity it dilutes, creating an upward cycle that benefits both the cryptocurrency and the company’s stock.

This feedback loop, often described as a “perpetual motion machine,” operates as follows: rising Bitcoin prices increase MicroStrategy’s stock valuation, enabling it to raise capital on favorable terms to purchase even more Bitcoin. These additional purchases contribute to upward pressure on Bitcoin’s price, further boosting the company’s valuation, and so on.

Looking ahead, the potential inclusion of MicroStrategy in the NASDAQ 100 index could act as another catalyst. Index funds tracking the NASDAQ 100 would be required to purchase MicroStrategy shares, potentially driving demand higher. If the company strategically times this with a substantial Bitcoin purchase, the combined effect could create a massive surge in both Bitcoin’s price and MicroStrategy’s valuation. Some optimists even speculate that this chain of events could propel MicroStrategy’s market cap past $200 billion and Bitcoin’s price above $100,000.

While this bullish scenario depends heavily on Bitcoin’s performance, it reflects the belief that MicroStrategy’s strategy of using cheap leverage to accumulate Bitcoin positions the company uniquely to benefit from the cryptocurrency’s long-term adoption.

Ultimately, MicroStrategy’s valuation illustrates the deep connection between its fortunes and Bitcoin’s trajectory. Investors are paying a significant premium for the opportunity to gain indirect exposure to Bitcoin through a traditional stock. For some, this premium is justified by the company’s innovative use of financial instruments and its pivotal role in the broader adoption of Bitcoin. For others, the risks associated with its leverage and the speculative nature of its valuation make it a precarious bet.

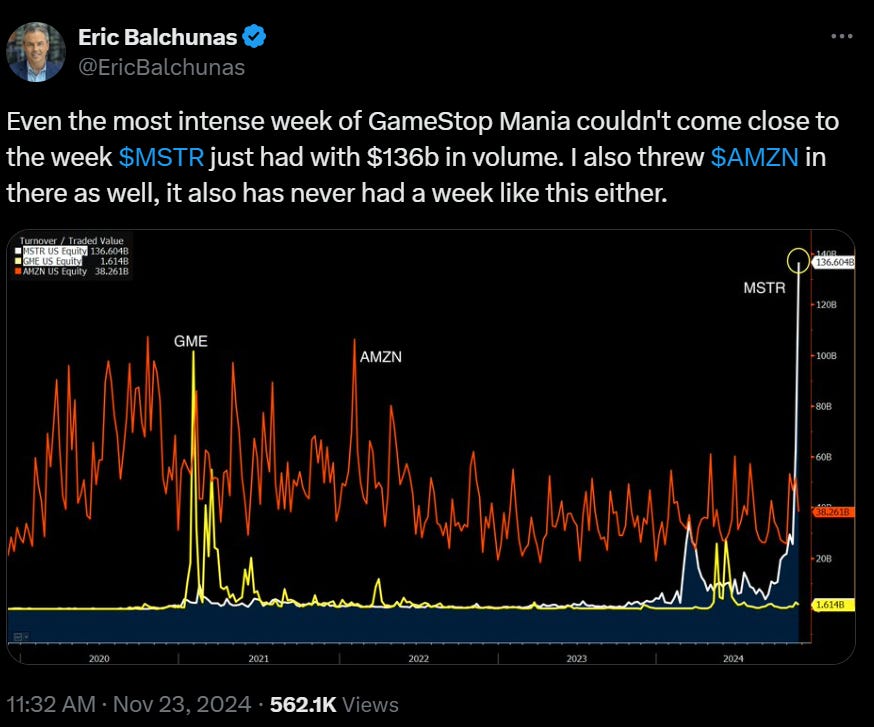

MicroStrategy stands as a case study in how traditional financial tools can intersect with the crypto market to create both remarkable opportunities and significant risks. Its unique approach to gaining exposure to Bitcoin has investors divided, causing volatility in the stock market that surpasses innovative technology stocks from the past.

Public Market Demand: A Look at Coinbase and Bitcoin ETFs

As traditional investors increasingly seek exposure to crypto assets, products like spot Bitcoin ETFs and publicly traded companies such as Coinbase have become essential tools for accessing the market. These avenues offer distinct advantages while catering to different aspects of public investor demand, reflecting the growing integration of crypto into mainstream financial systems.

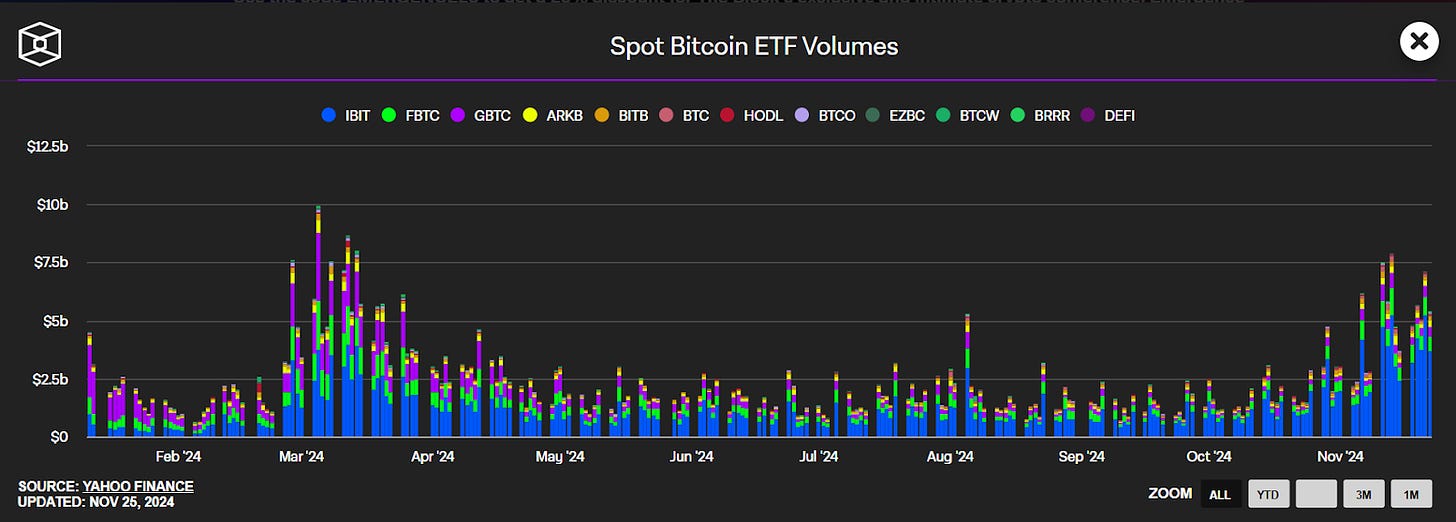

Spot Bitcoin ETFs have emerged as a popular choice, particularly among retail investors who dominate this market segment. According to Binance Research, retail investors account for 80% of the demand for Bitcoin ETFs, collectively holding over 938,700 BTC—worth approximately $63.3 billion. These ETFs represent 5.2% of Bitcoin’s total supply, underscoring their role in driving liquidity and reshaping market dynamics. By offering a regulated and straightforward way to invest in Bitcoin, spot ETFs eliminate the need for technical knowledge of private keys, wallets, or crypto exchanges. Investors can access these funds through their existing brokerage accounts, making Bitcoin exposure more accessible and convenient.

The appeal of Bitcoin ETFs extends beyond ease of use. These funds have contributed to market liquidity by absorbing an average of 1,100 BTC per day from circulation. In their first ten months, net inflows into Bitcoin ETFs exceeded $20 billion, far surpassing the $1.5 billion seen in gold ETFs during their debut year. This rapid adoption has improved Bitcoin’s market depth, reducing price volatility and increasing its attractiveness as an investment. Institutional participation has also grown significantly, with over 1,200 institutions now involved, compared to just 95 in the first year of gold ETFs. For both retail and institutional investors, Bitcoin ETFs provide a regulated and scalable way to include Bitcoin in their portfolios, reinforcing its position as a legitimate asset class within traditional finance.

While Bitcoin ETFs have captured significant market demand, Ethereum ETFs have struggled to gain similar traction, with cumulative net outflows exceeding $500 million as of November 2024. A key factor behind this disparity is the absence of staking features, which currently face regulatory restrictions in the U.S. However, analysts expect Ethereum staking ETFs to debut in 2025 as regulatory barriers ease. These ETFs could reduce management fees, increase staked Ethereum, and offer additional incentives for investors, potentially transforming Ethereum ETFs into a more competitive and attractive option for public market participants.

Coinbase, as a publicly traded company, offers a different but complementary path for public investors to gain exposure to the crypto market. Unlike Bitcoin ETFs, which track the performance of Bitcoin itself, Coinbase stock reflects the operations of a leading crypto exchange. Its business spans trading, staking, custody, and other blockchain-related services, giving investors access to a broader slice of the crypto economy. However, Coinbase’s reliance on the Ethereum ecosystem introduces an additional layer of specificity to its value proposition.

Coinbase operates Base, a Layer 2 blockchain built on Ethereum, which aligns the company closely with the success of the Ethereum network. Through Base, Coinbase is integrated into decentralized finance (DeFi) applications and non-fungible token (NFT) platforms, making its stock a proxy for Ethereum’s ecosystem. This connection allows investors to gain indirect exposure to Ethereum and its associated technologies without directly holding the cryptocurrency.

However, this focus on Ethereum also carries risks. Ethereum has faced increasing competition from alternative Layer 1 blockchains like Solana and Sui, which offer faster transaction speeds and lower costs. These networks have been steadily gaining market share, raising questions about Ethereum’s ability to maintain its dominance. As a result, investing in Coinbase stock is not just an investment in the broader crypto industry but also a strategic bet on Ethereum’s future growth and resilience.

For investors seeking exposure to crypto through public markets, both Bitcoin ETFs and Coinbase stock provide distinct opportunities. Bitcoin ETFs offer direct access to the price movements of Bitcoin, appealing to those looking for a straightforward and regulated investment. In contrast, Coinbase stock provides exposure to the operational and ecosystem-driven aspects of the crypto market, particularly within Ethereum’s network. While each route carries its own risks and benefits, together, they demonstrate the expanding role of crypto in traditional financial markets and the growing demand for accessible investment options in this dynamic sector.

The Opportunity in Solana Strategies

While Bitcoin and Ethereum dominate the crypto conversation, other blockchain networks like Solana present intriguing opportunities for investors. Solana, known for its high-speed transactions and scalability, lacks a direct ETF or similar vehicle for exposure in most markets. However, innovative strategies are emerging to fill this gap.

One such example is Sol Strategies, a Canadian market product designed to offer exposure to Solana through traditional brokerage accounts. By leveraging the same playbook as MicroStrategy—using corporate structures to hold and gain exposure to digital assets—companies like Sol Strategies provide a pathway for public investors to access Solana indirectly.

If Sol Strategies adopts financing methods akin to MicroStrategy, including leveraging debt to acquire Solana tokens, it could replicate MicroStrategy’s premium trading phenomenon. For investors, this represents a unique opportunity to gain exposure to one of the most promising blockchain networks without directly purchasing the asset.

Conclusion: Bridging the Gap Between Public Markets and Crypto

The public markets have always found ways to adapt to demand, and crypto is no exception. From MicroStrategy’s bold reinvention as a Bitcoin proxy to the growing adoption of Bitcoin ETFs and innovative strategies for accessing Ethereum and Solana, the landscape is evolving rapidly. These developments reveal a strong appetite among both retail and institutional investors for regulated and accessible crypto exposure, despite the growing pains of adoption.

As major players like Morgan Stanley only now begin to warm up to crypto recommendations, and as Ethereum staking ETFs loom on the horizon, the public markets are poised for even greater integration with digital assets. Whether it’s a speculative ride on MicroStrategy’s leveraged Bitcoin play, a bet on Coinbase’s Ethereum-driven growth, or a calculated move into emerging strategies like Sol Strategies, one thing is clear: crypto is no longer a fringe investment. For better or worse, it’s a feature of the mainstream—and the game is just getting started.

Resources: